Going Local Initiative exists to make homeownership affordable for low to moderate-income families in Clarksville, TN. As a Community Housing Development Organization, we are subject to the HUD established income & homeownership guidelines that qualify candidates as low to moderate-income.

Applicants MUST meet all four criteria to be eligible:

Program Guidelines:

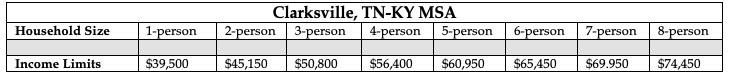

- Income Limits: Households who meet the income limits defined in the chart:

- First-Time homebuyers:

- An individual who has not held ownership in a principal residence during the three-year period ending on the date of the purchase.

- For couples, if one spouse is/was a homeowner but the other has not owned a home, both spouses are considered first-time homebuyers.

- A single parent who has only owned a home with a former spouse while married is considered a first-time homebuyer.

- An individual who is a displaced homemaker (has worked only in the home for a substantial number of years providing unpaid household services for family members) and has only owned a home with a spouse is considered a first-time homebuyer.

- An individual who has only owned a principal residence not permanently affixed to a permanent foundation in accordance with applicable regulations (such as a mobile home).

- An individual who has only owned a property not in compliance with state, local, or model building codes and cannot be brought into compliance for less than the cost of constructing a permanent structure.

- Mortgage payment <30% of monthly gross income

- Able to credit qualify for mortgage financing

- Candidates unable to credit qualify will be referred to credit counseling and credit repair assistance.

How it works:

Next Steps Overview:

Public Selection Lottery: Applicants who meet the eligibility criteria will be placed in the selection lottery where a public drawing will identify the qualified home buyers for each project.

Additional Information:

- Minimum funds from buyer $500

- Down payment assistance program may be available (Some programs may require additional funds from buyer)

- First time homebuyer education course required

- Candidates unable to credit qualify will be referred to credit counseling and credit repair assistance

If you meet all four eligibility requirements, click below to start your application